Let’s face it: NFTs, or non-fungible tokens, are revolutionizing every aspect of contemporary society, from finance to the arts. And there is every reason for us to believe it won’t end there.

NFTs have emerged as one of the most important and durable modern inventions in computing, economics, fashion, sports, memes, and the arts since the 1990s. Although enthusiasm, misunderstanding, and drama have been associated with NFTs, these emotions are also signs of a paradigm shift.

NFT stands for “non-fungible token.” It is a type of digital asset that is unique and cannot be exchanged for other assets on a one-to-one basis. NFTs are often used to represent digital artwork, collectibles, or other virtual items that have value to collectors. They are stored on a blockchain, which is a decentralized, digital ledger that allows for secure and transparent record-keeping.

NFTs have gained a lot of attention in recent years because they allow people to own and trade unique digital items in the same way that they might own physical items. They have been used to sell a variety of digital items, including artwork, music, and even tweets. Some people see NFTs as a way to monetize and protect their digital creations, while others view them as a way to invest in the future value of digital assets.

What’s the difference between NFTs and cryptocurrencies?

NFTs (Non-Fungible Tokens) are a type of cryptocurrency that represents ownership of a unique asset, such as a digital artwork or collectible. They are stored on a blockchain, like other cryptocurrencies, but they cannot be exchanged for other tokens or currencies on a one-to-one basis like most other cryptocurrencies can. This is because each NFT represents a unique asset, and the value of that asset is determined by its uniqueness and the demand for it.

In contrast, most other cryptocurrencies, such as Bitcoin and Ethereum, are fungible, which means that they can be exchanged for other tokens or currencies on a one-to-one basis. The value of these cryptocurrencies is determined by their market supply and demand, rather than the uniqueness of a specific token.

Overall, the main difference between NFTs and other cryptocurrencies is that NFTs represent ownership of a unique asset, while other cryptocurrencies represent a store of value or a means of exchange.

There are several reasons why someone might want to own an NFT:

- Rarity and uniqueness: Many NFTs are one-of-a-kind, or limited edition, which can make them highly coveted and valuable.

- Investment potential: Some NFTs have appreciated significantly in value over time, making them a potentially lucrative investment.

- Use as a digital asset: NFTs can be used to represent ownership of digital assets, such as artwork or music. This can be especially useful for creators looking to protect their intellectual property and ensure that they are properly compensated for their work.

- Personal enjoyment: Some people collect NFTs simply for the enjoyment of owning unique digital assets. Owning an NFT can be a way to show support for an artist or to express personal interests.

Now that you’ve decided to get an NFT, how does one create, buy, or sell NFTs?

Creating an NFT typically involves the following steps:

- Choose a blockchain platform: There are several blockchain platforms, such as Ethereum and EOS, that support the creation of NFTs. You will need to choose one of these platforms and set up an account on it.

- Create the digital asset: The digital asset that you want to turn into an NFT could be a piece of art, a collectible, or any other type of digital content.

- Create the NFT: Using the tools provided by your chosen blockchain platform, you can create a new NFT that represents your digital asset. This typically involves uploading the digital asset and setting various properties, such as the name and description of the NFT.

- Mint the NFT: “Minting” an NFT refers to the process of creating a new, unique instance of an NFT. During the minting process, you will need to specify the number of copies of the NFT that you want to create and pay a fee to the blockchain platform for hosting the NFT.

To buy an NFT, you will need to do the following:

- Choose a marketplace: There are several online marketplaces, such as OpenSea and Rarible, that allow you to buy and sell NFTs. You will need to choose one of these marketplaces and set up an account on it.

- Find an NFT that you want to buy: You can use the search and browse features of the marketplace to find NFTs that you are interested in.

- Place a bid or buy the NFT: Many NFTs are sold through auctions, where you can place a bid on the NFT. If you are the highest bidder when the auction ends, you will win the NFT. Some NFTs are also sold at a fixed price, in which case you can simply buy the NFT outright.

To sell an NFT, you can do the following:

- Choose a marketplace: As with buying an NFT, you will need to choose an online marketplace that allows you to sell NFTs.

- List the NFT for sale: You will need to provide information about the NFT that you are selling, such as its name, description, and artwork. You will also need to specify the price at which you are selling the NFT.

- Wait for someone to buy the NFT: Once you have listed the NFT for sale, it will be available for anyone to purchase. You will receive payment for the NFT once it is sold.

What are NFTs’ effects on the environment?

The environmental impact of NFTs depends on the blockchain platform that is used to create and host them. Some blockchain platforms, such as Ethereum, use a proof-of-work (PoW) consensus algorithm, which requires miners to perform computationally intensive tasks to validate transactions and create new blocks. This process consumes a large amount of energy, which can contribute to greenhouse gas emissions and climate change.

On the other hand, some blockchain platforms, such as EOS, use a proof-of-stake (PoS) consensus algorithm, which is less energy-intensive than PoW. In a PoS system, block validation is performed by “validators” who stake their own tokens to participate in the consensus process. This means that the energy consumption of a PoS system is largely dependent on the number of validators, rather than the number of transactions being processed.

Overall, the environmental impact of NFTs is a topic of ongoing debate and research. Some argue that the energy consumption of blockchain systems is a necessary trade-off for the security and decentralization that they provide, while others are working on ways to reduce the energy consumption of these systems.

NFT ownership and usage rights

NFTs (Non-Fungible Tokens) represent ownership of a unique digital asset, such as a piece of art or a collectible. The ownership rights associated with an NFT depend on the terms of the contract that governs the NFT and the laws of the jurisdiction in which the NFT is used.

In general, owning an NFT gives the owner certain rights over the digital asset represented by the NFT. These rights may include the right to use the asset, the right to sell or transfer the asset, and the right to profit from the asset. However, these rights may be limited by the terms of the NFT contract and applicable laws. For example, an NFT contract may specify that the owner of the NFT does not have the right to reproduce the digital asset represented by the NFT, or that the owner must pay a royalty to the creator of the asset when the NFT is sold.

It is important to carefully review the terms of an NFT contract before purchasing an NFT, in order to understand the rights and obligations associated with owning the NFT. It is also important to note that NFTs are still a relatively new and evolving technology, and the legal landscape surrounding NFTs is still being developed. As such, the ownership rights associated with NFTs may vary from jurisdiction to jurisdiction.

Be on the lookout for NFT market scams and issues.

As with any market, the NFT market has its share of scams and problems that you should be aware of. Some potential issues to watch out for include:

- Fraudulent NFTs: There have been instances of people creating and selling NFTs that are not genuine, or that are based on stolen or unlicensed content. It is important to carefully research the background of an NFT and the person or entity selling it before purchasing an NFT.

- Market manipulation: The NFT market has experienced significant price fluctuations in the past, which can be caused by market manipulation. This can occur when individuals or groups try to artificially inflate or deflate the price of an NFT by buying or selling large amounts of it.

- Lack of regulation: The NFT market is largely unregulated, which can make it difficult to resolve disputes or seek recourse if something goes wrong. It is important to be cautious when purchasing NFTs and to carefully research the reputation of the person or entity selling the NFT.

- Technical issues: There have been instances of technical issues with NFT marketplaces or blockchain platforms, which can result in delays or errors when buying or selling NFTs. It is important to be aware of these potential issues and to choose reputable platforms that have a track record of reliability.

- Limited liquidity: Some NFTs may be difficult to sell, especially if there is not a large market for them. This can make it difficult to liquidate your NFT holdings if you need to do so.

Overall, it is important to be cautious when buying and selling NFTs, and to do your due diligence in order to protect yourself from potential scams and problems in the market.

What are Things to Know About NFTs and Taxes

Here are a few things to consider when it comes to taxes and NFTs:

- NFTs may be subject to capital gains taxes: If you buy an NFT and then sell it for a profit, the profit may be subject to capital gains taxes. The tax rate that you will pay on your NFT profits will depend on your tax bracket and how long you held the NFT.

- NFTs may be subject to self-employment taxes: If you create and sell NFTs as a business, you may be subject to self-employment taxes in addition to regular income taxes.

- NFTs may be subject to sales tax: Depending on your location and the laws of your jurisdiction, you may be required to pay sales tax on NFT purchases.

- Keep good records: It is important to keep good records of your NFT transactions, including the date of purchase, the price paid, and any fees associated with the transaction. This will help you accurately report your NFT profits or losses for tax purposes.

- Consult a tax professional: Tax laws can be complex, and it is always a good idea to consult with a tax professional if you have questions about how NFTs are taxed. A tax professional can help you understand your tax obligations and ensure that you are in compliance with the law.

Look back at how NFTs got started

The concept of non-fungible tokens (NFTs) dates back to the early days of cryptocurrency. The first NFTs were created on the Bitcoin blockchain in 2012, with the launch of the Mastercoin protocol. However, it wasn’t until the emergence of Ethereum and its support for smart contracts that NFTs began to gain widespread attention.

In 2017, the first major NFT marketplaces, such as OpenSea, Cryptopunks and CryptoKitties, emerged, allowing users to buy and sell NFTs on the Ethereum blockchain. These early NFTs were mostly used to represent digital collectibles, such as virtual cats and other digital assets.

In the years that followed, the use of NFTs expanded to include a wide variety of digital assets, such as artwork, music, and even tweets. The market for NFTs has grown significantly, with some NFTs selling for millions of dollars.

In recent years, the use of NFTs has become more mainstream, with major institutions, such as the Metropolitan Museum of Art and the NBA, beginning to experiment with NFTs as a way to represent and sell digital assets.

A timeline of some innovative and popular NFTs:

- 2012: The Mastercoin protocol launches on the Bitcoin blockchain, introducing the concept of non-fungible tokens (NFTs).

- 2017: The first major NFT marketplaces, such as OpenSea and CryptoKitties, emerge on the Ethereum blockchain.

- 2017: The first “Crypto Art” NFTs are created, representing digital artwork.

- 2018: The blockchain game CryptoSpaceX launches, allowing players to buy and sell NFTs representing in-game assets.

- 2019: The blockchain platform Flow launches, enabling the creation of NFTs for use in the gaming industry.

- 2020: The NBA and Top Shot launch, allowing fans to buy and sell NFTs representing NBA highlights and other digital collectibles.

- 2020: Digital artist Beeple sells an NFT artwork for $69 million at a Christie’s auction, setting a record for the highest price ever paid for an NFT.

- 2021: The first NFT-based social media platform, Mirror, launches, allowing users to buy and sell NFTs representing their posts and interactions on the platform.

- 2022: The first NFT-based virtual reality platform, Decentraland, launches, allowing users to buy and sell NFTs representing virtual real estate and experiences.

Should I get into NFTs?

It is difficult for me to determine whether NFTs are right for you without knowing more about your personal circumstances and goals. Here are a few things to consider when deciding whether NFTs might be a good fit for you:

- Are you interested in owning unique digital assets? If you are interested in collecting rare or one-of-a-kind digital assets, such as artwork or collectibles, NFTs may be a good fit for you.

- Do you have the financial resources to buy NFTs? NFTs can vary significantly in price, with some selling for hundreds or thousands of dollars. You should only consider buying NFTs if you have the financial resources to do so and are comfortable with the risk of losing your investment.

- Are you comfortable with the technology? Buying and selling NFTs requires a basic understanding of blockchain technology and the use of cryptocurrency. If you are not comfortable with these concepts, NFTs may not be a good fit for you.

- Are you prepared to keep track of your NFTs for tax purposes? If you buy and sell NFTs, you will need to keep track of your transactions for tax purposes. You should be prepared to do this, or to seek the help of a tax professional, if you decide to invest in NFTs.

Ultimately, whether NFTs are right for you will depend on your personal interests, financial resources, and comfort level with the technology. It is always a good idea to do your own research and carefully consider your options before making any investment decisions.

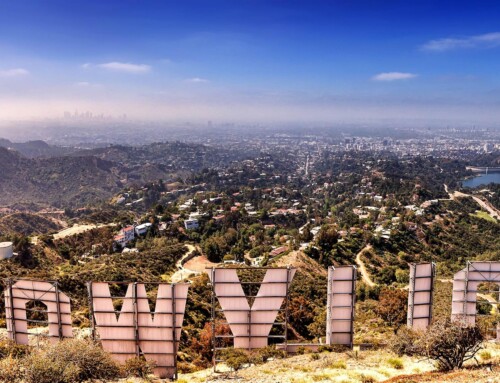

If you would like to know more about developing your own NFTs, contact Los Angeles Software Developers today to discuss your upcoming project with a NFT Developer.